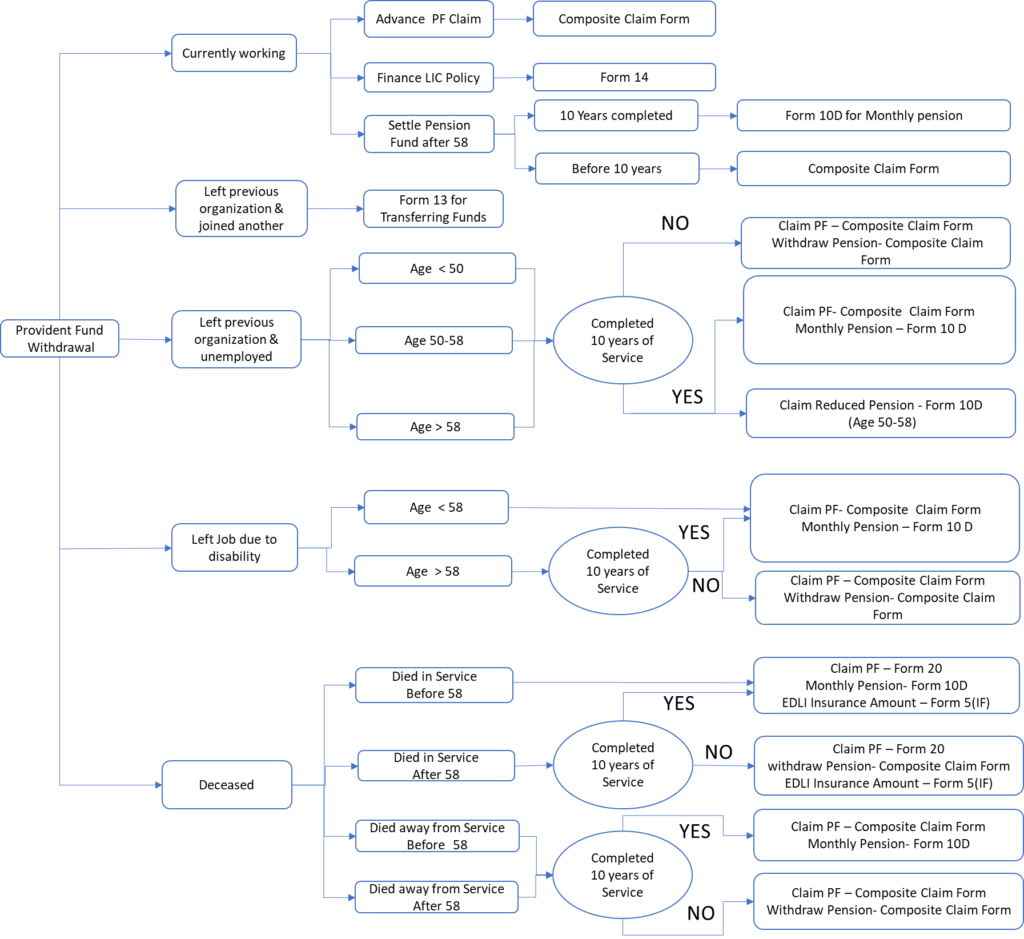

One thing that comes to mind when we think of withdrawing provident fund is their long and cumbersome process. It’s mainly because of the different forms required to withdraw/transfer your PF amount. Today in this blog we will walk you through all kind PF forms which are required at different stages of PF withdrawal and for different conditions. To make your understanding easier we have made a flowchart which will guide you which form to be used at what situation.

Let’s understand each of these forms in depth and their use cases

Composite Claim Form

A composite claim form is a basic way to claim your PF under the Employees’ Provident Fund in India and has replaced three older forms : Form 19 (PF Final Settlement), Form 10C (Pension Withdrawal Benefits), and Form 31 (PF Part Withdrawal). It is of an advantage as it reduces the need of multiple documentary requirements and further attestation by the employer at the PF office.

This form is of two types that is Aadhar and Non- Aadhar form.

- The Aadhar form is used by employee who has linked his Aadhar number to his account number through the UANI of the bank account. The employee can submit the form directly to pf office without employer attestation

- The Non- Aadhar form is used by the employee who have not linked his Aadhar account number to his UAN account. The employee or rather the employer is supposed to submit this form at the PF office and the form must be signed by the employer before the employee presents it to the PF office.

You can use composite Claim form the following cases.

Final Settlement of PF (Form 19): You can use it to withdraw your entire PF balance when you leave your job, regardless of your service period.

Pension Withdrawal Benefit (Form 10C): If you haven’t completed 10 years of service, you can claim your PF amount and a pension scheme certificate through the composite form.

Partial Withdrawal (Form 31): In certain situations, you can use it to withdraw a portion of your PF balance before leaving your job.

Form 10D

Form 10D is specifically for applying for a monthly pension under the Employees’ Pension Scheme (EPS) in India. It’s different from the composite claim form, which is used to withdraw your PF funds. You will get monthly pension after if met the eligibility criteria. In most of the cases you should have completed at least 10 years of service to be elibigle for monthly pension but there are some exceptions like in case of disability or deceased person where you can claim this irrespective of service period. Refer to flowchart above to get better clarity.

Form 14

Form 14 is your gateway to using your Employees’ Provident Fund (EPF) savings to pay premiums for your Life Insurance Corporation (LIC) policy in India. to meet eligibility criteria you should have been an EPF member for at least two years and have enough balance to cover two years of LIC premiums. This form allows you to authorize automatic deductions from your EPF account. However, your annual EPF contributions should also be sufficient to handle the yearly LIC cost.

Form 13

Form 13 is use to transfer your entire PF balance, including both your contributions and your employer’s contributions, from your old employer’s account to your new one. This keeps your service history unbroken for pension calculations. It’s important to note that while your PF balance is transferred, any pension contributions you’ve made won’t be transferred unless both employers are exempt under the pension scheme. Additionally, money in the Employees’ Deposit Linked Insurance (EDLI) scheme doesn’t get transferred – its benefits depend on when the employee dies, regardless of their job history.

Form 20

Form 20 is designed specifically for nominees (the person designated to receive PF benefits of deceased person) or legal heirs (spouse, children, parents in the absence of a nominee) to withdraw the deceased member’s PF balance. Even guardians can use Form 20 on behalf of minor nominees or heirs.

Through Form 20, you can claim both the employee’s contributions to the PF and the employer’s share. In some cases, depending on the member’s service and choices, you might also be able to claim benefits from the pension scheme. You can also use Composite Claim Form [Form-20 (PF Payment)/Form-10-D (Pension)/ Form – 5 IF (EDLI)] for claiming PF, pension and insurance amount together in case member has died while in service.

Form 5(IF)

Form 5IF helps nominees or families to claim insurance benefits under the Employees’ Deposit Linked Insurance (EDLI) scheme. This scheme offers a safety net by providing financial aid in case an active PF member passes away. Claimant needs to fill out a form, and employer verification is usually required. However, if the employer is unavailable, a gazetted officer can provide attestation instead. In case of a minor a guardian can fill form on his behalf.

Form 15G

Form 15G is a self-declaration form used in India to avoid Tax Deducted at Source (TDS) on your interest income from fixed deposits (FDs), recurring deposits (RDs), and other similar investments. If you are withdrawing your PF amount without completing 5 years of service and amount more than 50,000 then you have to submit this form to save tax on your Interest. for senior citizens for used is 15H.

Form 5

Form 5 has to be filled by companies who are hiring freshers/employees who didn’t Pf account before. Filling out Form 5 isn’t just about creating an EPF account for a new employee. It also acts as a first step to check their eligibility for the scheme. The EPFO offers other benefits beyond the EPF, such as the Employees’ Pension Fund (providing a pension upon retirement) and the Employees’ Deposit Linked Insurance (offering financial aid to a member’s family in case of death).

So That’s all you need to know about PF related forms. The cases mentioned here are not exhaustive and things can get more complicated depending upon particular cases. But you don’t need to worry about that as our experts are always there to guide you so that you can get your hard earned money without any hassel. If need arises feel free to Whatsapp us on 8983070445. For any help regarding personal finance head on to our website Finright.

We hope these insights on Provident Fund related forms equipped you with the knowledge to handle your PF efficiently. Don’t miss out on more insightful updates and tips—follow us on our social media channels (Instagram, YouTube, Linkedin, Facebook ) to stay informed and empowered about managing your finances effectively. Join our Whatsapp community and be part of the conversation.

I am extremely impressed along with your writing talents as neatly as with the layout in your weblog. Is that this a paid subject or did you customize it yourself? Anyway stay up the excellent high quality writing, it is uncommon to look a great blog like this one today..

Hi, I have 3 PF accounts that are having old type account number, not linked or assigned any UAN. Two of the companies got closed, however 3rd one is not encouraging any help to link PF account to my current UAN.

I had filed RTI to PF authorities to seek help in linking the old fashion PF to my current UAN, however there is no reply.

Also, I tried multiple ways online/videos etc., there is no proper method explained how to link old accounts to new UAN.

Please help me to resolve this, I can provide the full details of old PF account numbers.

Also let me know the fee structure.

Thanks

Vignesh

Hey vignesh, you can reach out to us at Finright.in or Share your contact details our team will reach put to you