Introduction: Why This Report Matters

The Employees’ Provident Fund Organisation (EPFO) is more than just a monthly salary deduction. It’s a social safety net that protects over 32 crore Indians, serving as a retirement fund, emergency backup, and long-term savings mechanism.

The just-released EPFO Annual Report 2023–24 offers deep insights into how India’s salaried population is saving, claiming, and receiving pensions, and where the system is still failing them.

Here are 10 key takeaways that every working Indian needs to understand right now.

32.56 Crore EPFO Members – That’s Almost the Population of the US

As of March 31, 2024, EPFO had over 32.56 crore members — a mix of current contributors and inactive accounts. That’s bigger than the entire adult population of several countries combined.

This massive coverage shows how deeply entrenched EPFO is in India’s formal employment economy.

1.19 Crore New Members Joined EPFO in Just One Year

In FY 2023–24, 1,19,73,456 new members were enrolled. This points to:

- A strong push toward the formalisation of jobs

- Government schemes like Aatmanirbhar Bharat Rozgar Yojana are working on-ground

- More MSMEs and gig workers entering the EPFO net

Over 20 Crore UANs Issued for Seamless Portability

EPFO issued 20.31 crore UANs (Universal Account Numbers) till March 2024. These allow workers to:

- Maintain a single PF identity across jobs

- Transfer PF easily

- Monitor balance and claims online

It’s the backbone of a tech-driven future for India’s social security.

7.37 Crore Active Contributors This Year

These are the members who actually made at least one PF contribution in FY 23–24. It highlights the portion of India’s workforce actively using EPFO as a savings vehicle.

4.45 Crore Claims Settled – An All-Time High

A total of 4.45 crore claims were processed during the year, including:

- Final settlements

- Transfers between employers

- Part withdrawals for medical, education, marriage, and housing

That’s 1.8 lakh claims every single day.

78.49 Lakh pensioners now take support from EPFO

EPFO now disburses pensions to nearly 8 million people, paying out over ₹15,000 crore annually under EPS 1995 alone.

1 in 4 EPFO Claims Get Rejected — Why That Should Worry You

Here’s where the numbers get serious:

- Total claims received: 6.23 crore

- Total rejections/returns: 1.59 crore

- That’s a 25.5% rejection rate

Some forms have even higher rejection rates:

- Form 10C (pension withdrawal/scheme certificate): ~40.3%

- Form 10D (monthly pension claim): ~39.8%

- EDLI death claims: ~29.4%

- PF Final Settlement (Form 19): ~30.4%

Main reasons: KYC issues, bank detail mismatches, employer verification problems, missing documents.

Auto-Settlement Now Up to ₹5 Lakh – Major Win

EPFO has raised the auto-settlement limit from ₹50,000 to:

- ₹1 lakh (May 2024)

- ₹5 lakh (June 2025)

That means emergency claims up to ₹5 lakh can be processed without human intervention, drastically reducing wait times.

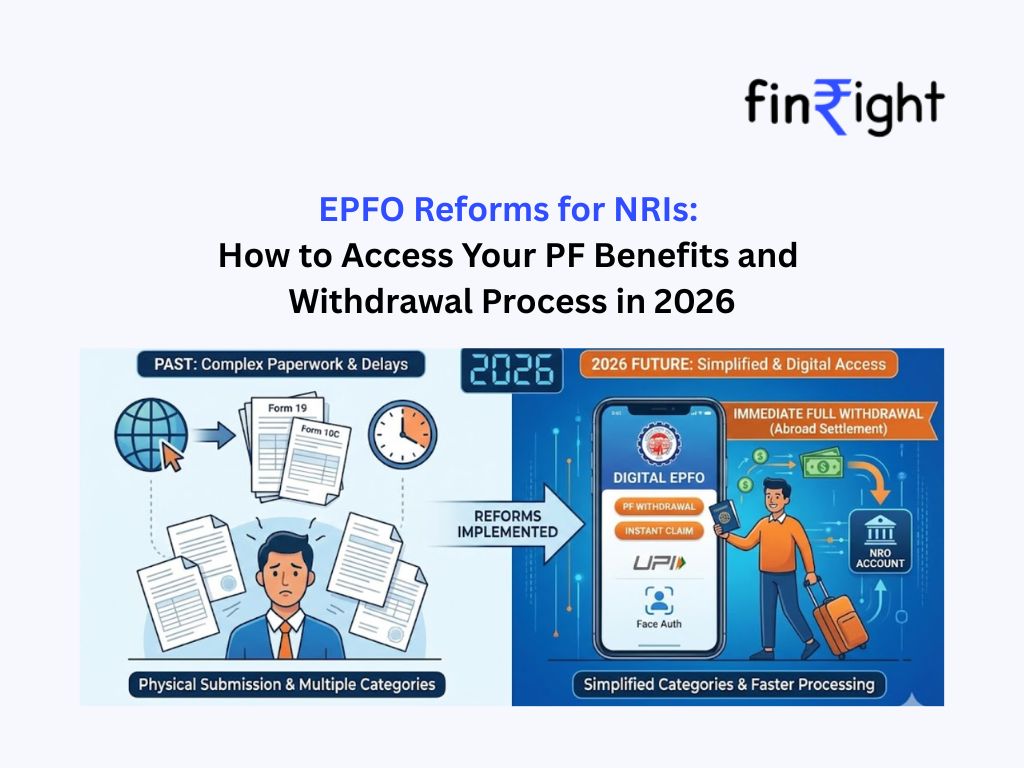

New Tech, Better Governance, What Is The Real Progress?

EPFO is:

- Phasing out employer certification for certain claims

- Removing cheque uploads and bank passbook mandates

- Using facial authentication for digital life certificates (DLCs)

- Upgrading systems with Core Investment and Trust Engagement System (CITES)

While automation and simplification have helped many, some users still face issues — especially around claim rejections due to KYC mismatches or procedural gaps.

As the system evolves, continued improvements in transparency and support will be key to ensuring every member truly benefits from these reforms.

What You Can Do as a Member

- Update KYC on the EPFO portal

- Check bank and Aadhaar linking

- Use UAN for tracking

- Submit claims via online mode only

- Regularly monitor passbook balance

EPFO Isn’t Just a Stat, It’s Your Future

The 2023–24 report shows how deeply EPFO affects Indian livelihoods — from first-job starters to retired pensioners. While rejections are still high, reforms are clearly kicking in.

If you’re salaried, don’t ignore your PF. It’s your future security.

Follow finright for more such news!

FAQs

Q1. What is the current interest rate on EPF for FY 2023–24?

A. EPFO has declared 8.25% interest on EPF deposits for FY 2023–24.

Q2. Can I withdraw my EPF online without employer approval?

A. Yes, for many claim types (like advances and final settlement), EPFO has removed employer approval in cases of verified Aadhaar.Q3. What should I do if my EPF claim gets rejected?

A. Check for KYC mismatches, correct errors in Aadhaar or bank details, and reapply online.