When you change jobs, it is important to transfer your Provident Fund (PF) balance from the old employer to the new one. While the online process through EPFO’s Unified Portal is most common, employees can still use Form 13 (offline) to request a transfer. This blog will guide you through each component of Form 13, referring to the official EPFO document, and explain how to fill it correctly to avoid rejections.

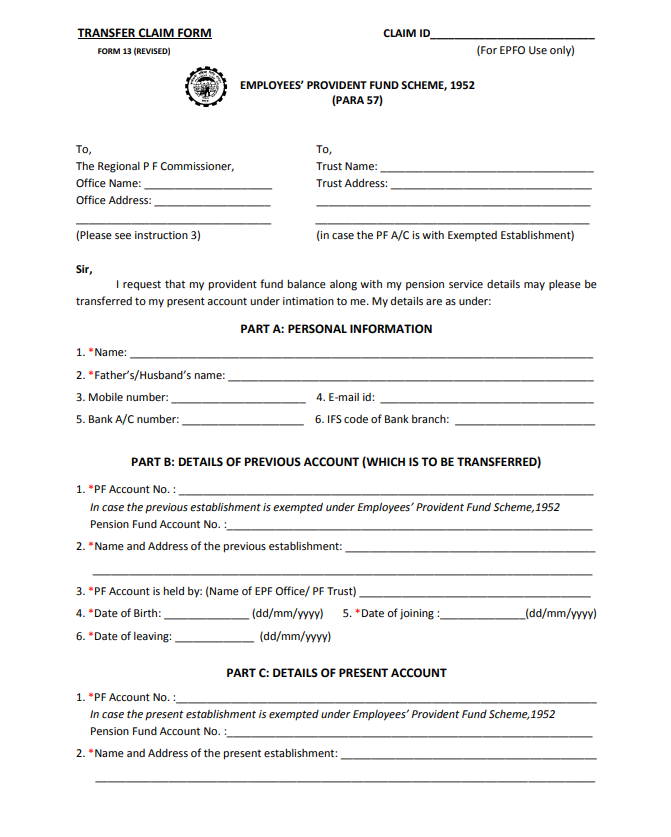

What is Form 13?

Form 13 is issued by the Employees’ Provident Fund Organisation (EPFO) and is used to transfer PF accumulations from one account (old employer) to another (new employer). It ensures continuity of PF membership and pension service history.

Structure of Form 13 and How to Fill It

https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form13.pdf?utm_source=chatgpt.com

Form 13 is divided into multiple sections. Below is a detailed explanation of every field:

1. Employee’s Details

- Name of the Member: Enter your full name as per EPFO records and Aadhaar.

- Father’s / Husband’s Name: Ensure the name matches your PF records.

- Date of Birth (DOB): Use DD/MM/YYYY format.

- Mobile Number & Email ID: Provide current contact details for updates.

- PF Account Number with Previous Employer: Mention the full member ID of the old company.

- UAN (Universal Account Number): Mandatory. If you don’t know it, you can find it on the EPFO portal.

- Aadhaar Number / PAN: For KYC validation.

2. Details of Previous Establishment

- Name & Address of Previous Employer: As per your salary slips or appointment letter.

- PF Account Number (Old Member ID): Carefully copy from your PF passbook/Annexure K.

- Date of Joining and Date of Leaving: As recorded in EPFO database.

3. Details of Present Establishment

- Name & Address of Present Employer: Mention your current organisation’s details.

- PF Account Number (New Member ID): Collect this from your HR/EPFO passbook.

- Date of Joining the Present Establishment: Use official joining date from HR records.

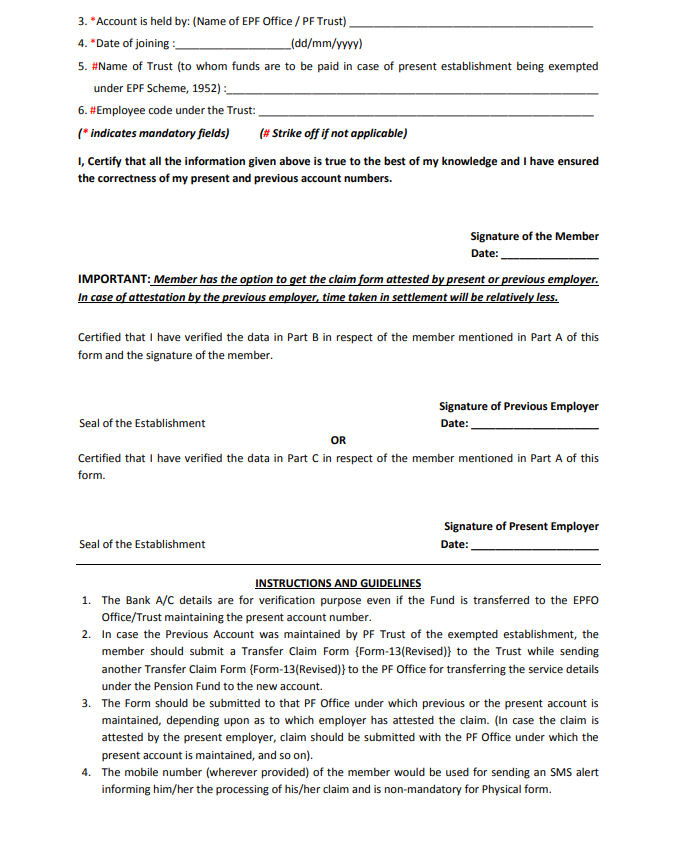

4. Employment Category

- Tick the applicable box (Private / Public Sector / Central Govt. / State Govt. / Others).

5. Declaration by the Member

- Confirm that you have only one UAN.

- Declare that the information provided is true and correct.

- Sign and date the form.

6. Attestation by Present Employer

- The present employer must attest and stamp the form before submission to the PF office.

- Without employer attestation, the form is not valid.

Facing Issues With PF Transfer?

SGet expert help to move your PF smoothly to your current account.

✔ Clear timelines

✔ Fixed fees with no surprises

✔ Zero-risk success guarantee

✔ End-to-end expert support

Submission Process

- Fill the form completely in block letters.

- Attach supporting documents like Aadhaar, PAN, and salary slips.

- Submit the attested form to your current employer, who will forward it to the EPFO Regional Office.

- Track the status using your UAN at the EPFO Member e-Sewa Portal.

Common Mistakes to Avoid

- Using a different name spelling than Aadhaar/PF records.

- Not mentioning UAN.

- Leaving joining or exit dates blank.

- Submitting without employer attestation.

Why Form 13 Matters

- Preserves pension service history (EPS).

- Avoids multiple PF accounts and UANs.

- Ensures continuity for withdrawals, loans, and final settlement.

Do You Need Help With PF Transfers and Withdrawals?

Filling Form 13 offline is possible on your own, but many people face challenges like missing exit dates, EPS service continuity errors, or even multiple UANs. In such cases, working with a PF consultant can save time and reduce stress.

For example, if you’re based in Mumbai, many employees search for PF agents in Mumbai or PF consultants in Mumbai when their transfer claims are repeatedly rejected. Similarly, professionals in Bangalore and Delhi often look for trusted PF consultants who can step in and coordinate with employers or the EPFO office on their behalf.

If you are uncertain about the PF withdrawal rules—such as eligibility after leaving a job, partial withdrawals for housing or education, or the tax treatment of final settlements—a consultant can explain the process clearly and even handle the paperwork.

And if you’re typing PF consultants near me into Google, what you really want is someone reliable and accessible who can ensure your Provident Fund money is not stuck because of clerical errors or mismatched records. That’s where FinRight comes in — the one for you. With years of experience resolving complex PF cases, FinRight ensures your transfer or withdrawal is completed smoothly, without endless back-and-forth with EPFO.

Final Thoughts

Filling Offline Form 13 is straightforward if you follow the official instructions carefully. Always ensure consistency in your records (name, UAN, dates, and KYC details). In case of issues, professional PF consultants can provide additional guidance and help resolve complexities with the EPFO.

Stuck With a PF Transfer?

Move your PF smoothly from your previous employer to your current one.

Talk to a PF expert to understand transfer eligibility, fix issues, and complete the process without stress.

Why Choose Us?

✔ Expert review of your PF transfer case

✔ Clear guidance on next steps and timelines

✔ Fixed fees with no surprises

✔ End-to-end support till transfer completion