Myth: EPF interest stops after three years of no contribution.

Truth: Your EPF account continues to earn interest until you turn 58, even if no contributions are made.

The Employees’ Provident Fund (EPF) is a trusted savings tool for salaried individuals, helping them build a secure retirement fund while enjoying tax benefits. However, many misconceptions surround the EPF, especially about interest accrual after leaving a job or retiring.

At FinRight, India’s leading fintech platform specializing in EPF solutions, we’ve resolved over 5,000 EPF cases. Let’s break down the facts to clear up confusion and help you maximize your EPF savings.

Understanding the Facts: EPF Interest Policy

- Policy Update in 2016

A Press Release dated 29.03.2016 from the EPFO Head Office confirmed that interest crediting resumed even on accounts previously deemed “inoperative” since 2011. Starting 01.04.2016, all accounts—regardless of their contribution status—would continue to earn interest until the member reaches the age of 58. This demonstrates a direct policy shift prioritizing the growth of your retirement corpus over arbitrary inactivity periods. - Further Clarification in 2017

A government notification (Ministry of Labour & Employment) in July 2017 redefined “inoperative accounts.” Now, EPF accounts become inoperative only when the member reaches 58 years of age. Before that, interest accrual continues, regardless of contribution.

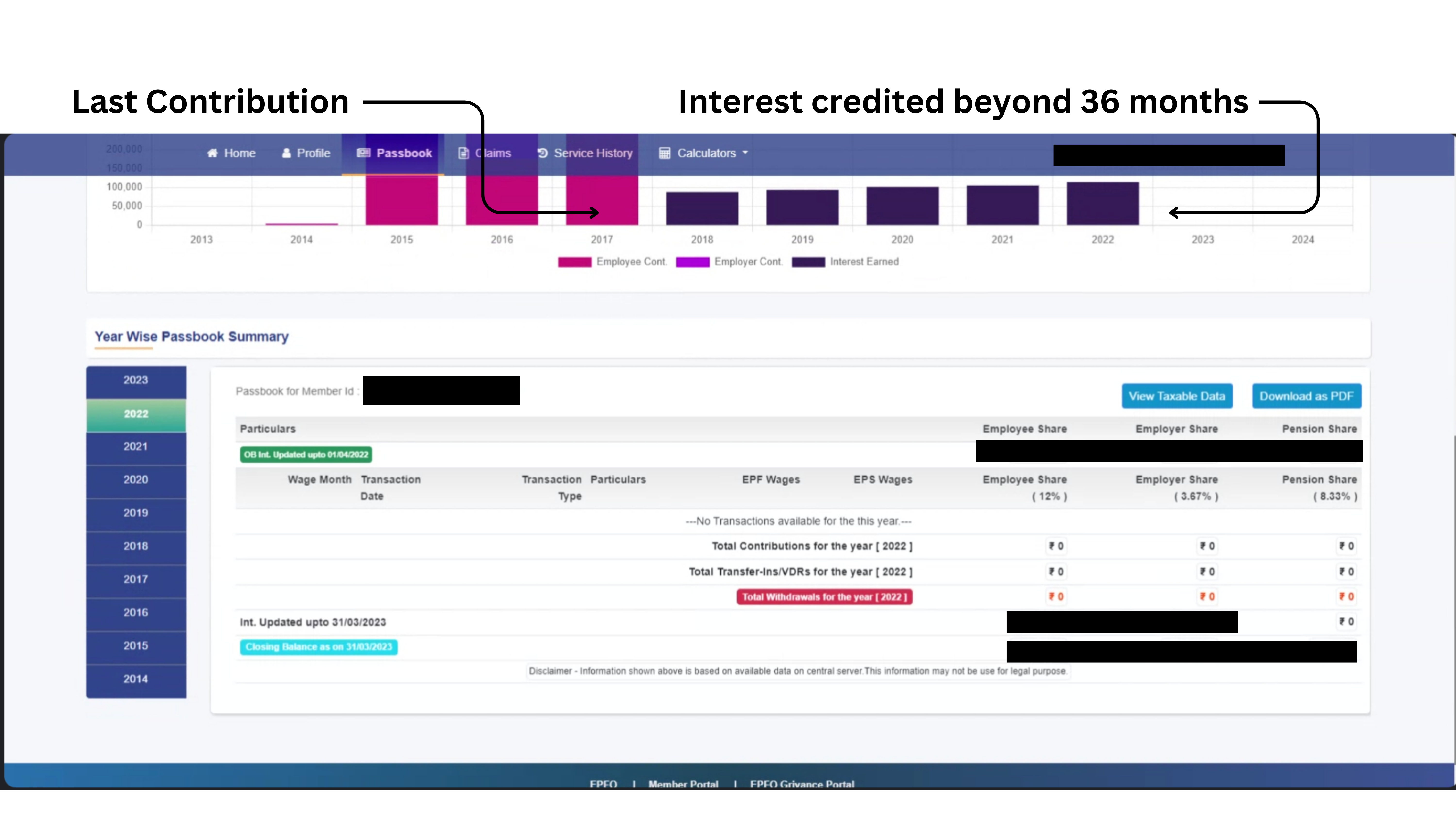

Proof from Real-World Cases

At FinRight, we’ve validated this with actual customer data. For instance, one customer’s passbook showed interest accrual on their EPF balance, even though contributions stopped in 2017. This matches the updated policies, proving that your savings don’t stagnate after three years of inactivity.

Key Takeaways for EPF Members

- Interest Continues Until Age 58

Whether you stop working at 40, 45, or 50, your EPF account keeps earning interest until you turn 58. - Don’t Withdraw Prematurely

Acting on myths could lead you to withdraw your funds early, losing years of compounding growth. Trust official updates and let your savings grow. - Stay Informed to Maximize Benefits

By staying updated on EPF policies, you can make decisions that secure your retirement corpus.

Why Trust FinRight?

With over 5,000 EPF cases resolved, we are your trusted partner for provident fund solutions. We provide expert guidance and ensure your Provident Fund is available for you when you need it. Reach out to our experts and get your PF checked today!

Is this true for International Workers from countries without a SSA as well?

Yes, but the interest is taxed

I left private job inJune 2015 and thereafter there is no contribtuion to EPF account. So it must have become inoperative.

Now I am completeed 60 years of age in 2025 . Upto which year interest will be accrued and credited to my EPF account and if now , there will be no interest accrual ( after 60 yrs of age and no contribution since 2015). then is it advisable to withdrawn the whole amount?

Request you to please clarify

You would have earned interest up to 58 years of age, afterwhich you can withdraw or if you were an EPS member you can start with monthly pension

I have left my job in April 2025 after working for 17 years. And I am 41 years old only. Now I want to start my own business and requires fund in 3 tranches in next 3 years, means 40% in 2026-27, 30% in 2027-28 & remaining 30% in 2028-29.

Can I get it? And if yes is it tax free?

Can you withdraw in 3 parts?

Yes, you can

– Do not file final withdrawal if you plan to access funds in stages.

– Use Form 31 for advance claims.

Tax Implication:

Since you’ve completed more than 5 years of service:

All PF withdrawals will be 100% tax-free

Even if you withdraw in parts over 3 years, no TDS will be deducted, and you won’t owe tax on the amount.

I am currently facing the same issue. My account has become inoperative in march 2025. And hence no interest is credited to my account since 36 months have elapsed since my last contribution in the year 2022. So I made a final PF withdrawal request via form 19 on 3rd May 2025 since no interest is credited for PY 2024 – 2025 .Also, I have contributed for more than 5 years continuously. But I haven’t received this amount till date. Nor the amount has been settled despite bank is already verified.

Hey lets connect to see how we can help you regarding this.

you can raise query at Finriht.in

I left my previous job in june 2024 and have moved abroad. I have 14 lac pf balance through pf(3k) and vpf (22k)contribution.

Q. Will the interest earned after I stopped making contribution taxable?

Q. Will I be taxed on the pf amount If I withdraw it ?

Q1: Is post-resignation interest taxable?

No, the interest is not taxable just because you’ve resigned. Taxability depends on whether your PF contributions in any financial year exceeded ₹2.5 lakhs. If they did, the interest earned on the excess amount is taxable from FY 2021–22 onwards, as per the rule introduced in April 2021.

In your case, since the PF account was opened before 2021 in 2014. Thus, interest remains tax-free

Q2: Will PF withdrawal be taxed?

If total PF service > 5 years → ✅ Fully tax-free

If < 5 years → ❌ Partially taxable - Employer share & interest = Taxable as salary - Interest on employee share = Taxable - Your own contribution = Not taxed, but 80C benefits reversed Other Points: -Update PAN in PF account to avoid 34.6% TDS -As an NRI, Indian taxes apply on interest & withdrawal (check DTAA with new country)

I left my job in Aug’2011. since then there has been contribution in PF account. will I get interest .

now I am 52 years old.

Yes if you have not withdrawn. you will receive interest on the same.

Hi,

I left my job on Sep 2023 and currently pursuing business. There has been no PF contributions from Sep 2023. In my PF passbook , I dont see interest contributions from Sep2023 till June 2025. Please let me know whether interest will be earned for dormant accounts. Information regarding interest for Inoperative accounts on EPFO website is not very clear.

Appreciate your advice on the same.

Regards,

Asha

Even if a PF account becomes inoperative, EPFO continues to credit interest up to the age of 58, as long as the amount hasn’t been fully withdrawn or transferred.

It’s just that the interest may not always reflect immediately in the passbook due to system delays.

since Jan’2005 to Jul’2008 I worked as off role employee in Bharti Airtel Ltd through Mai Foi Placement Consultant Chennai based Pvt Company. there is no documents with me already lost. in 2012 I have visited in Mai Foi office in Patna and withdrew my PF amount but EPS left. now unable to find Ma Foi Office in patna perhaps not running in Patna. Pls guide me how I can get my Pension amount .

since Jan’2005 to Jul’2008 I worked as off role employee in Bharti Airtel Ltd through Mai Foi Placement Consultant Chennai based Pvt Company. there is no documents with me already lost. in 2012 I have visited in Mai Foi office in Patna and withdrew my PF amount but EPS left. now unable to find Ma Foi Office in patna perhaps not running in Patna. Pls guide me how I can get my Pension amount .

you can do offline withdrawal of pension amount. through the company regional office.

Namaste,

I have made a premature withdrawal of my entire EPFO money(using Form-19), one month back.

I was under the assumption that 3 years of non-contrubution renders the EPF account inactive and it doesn’t accrue any interest, until I saw this thread here.

Is there any remote possibility to transfer back the withdrawn amount back to my EPFO account?

Thanks`

Hi, lets connect their is a process for this.

Hi

I did not get PF transferred from employer no. 1 to 2 so I have separate PF balance reflecting in both employer no. 1 and employer no. 2 accounts. Last contribution in my EPF account was in September 2019 by employer no. 2. After quitting employer no. 2 i joined employer no. 3 who had its own private PF trust. On quitting employer no. 3 i withdrew the PF balance from their private trust. My current employer no. 4 has not opened my PF account and doesn’t deduct PF from my salary. I would like to know would i be still earning interest till date on both PF balances of employer 1 and 2? Also how can i withdraw my corpus as i do not have PF account from current employer.

Yes, you will earn interest on previous company PF account.

You can also withdraw the full EPF corpus as EPFO consider this as unemployment.

I left my first company in 2008 and that PF account is not linked to my current UAN. That company is closed long since but I have all details of that PF account along with my payslips but I am not able to connect it to my UAN. Will that old PF account be accruing interest until I reach 58 years, under the new rules. Or did it stop accruing after interest 3 years after I left the company in 2008, that is after 2011?

It would earn interest till the age 58, and you can do an offline linking to your pf account to UAN.

Hello.,

I was employed by a company in chennai from 2009 to 2018, and deputed for an assignment to their headquarters in abroad from 2018 until Aug 2022. Now i become a permanent employee of the headquarters company and continued to live in abroad. The PF contribution by chennai employer was stopped after Aug 2022. I have seen the interest credit until 2024 . I have not seen the interest credit yet for 2025.

Q1 : Do the interest credit for 2025 happens, if so when it will be credited normally?

Q2: Do i eligible to get the interest credit further as i am working in abroad , if so how long the interest credit happens ? is it unitl i reach age 58 ?

Q3: When can i withdraw the PF amount ? As i am an NRI, is there any restriction for the withdrawal ?

Please do resolve my query. Thank you

Q1: Yes, interest for FY 2024–25 will be credited — usually between July and October 2025.

Q2: Yes, interest will continue, but it will be taxed.

Q3: You can withdraw anytime after becoming an NRI or after 2 months of non-contribution — there are no restrictions.

I lost my job in 2015 and couldn’t find any job afterwards. I am now 55 years old. Whether the epf balance continue to earn interest ? The interest accrued is taxable?

Hey, you will earn interest till the age 58 but it will be taxed!

Hello,

In replying to questions earlier you mentioned interest earned is tax free until the age of 58 even account has no contributions for more than 3 years. But you are mentioning, it will be taxed. Please explain

Hey, you will earn interest on your PF till the age of 58 years. However, interest becomes taxable if your total annual contribution exceeds ₹2.5 lakhs — the interest earned on the excess amount will be taxed.

Also, if you are not working, the interest earned during that period will be taxable as well.

Can you confirm if the EPF interest will be the same 8.25% or whatever is ratified every year, compounded yearly as it is being done now as the account is active, or will it be simple interest only?

Hey it will be compounded yearly.

I had worked in Aristo Pharmaceuticals Ltd in Lucknow from Jan’2000 to Oct’2000.Aristo pharmaceuticals Ltd Mumbai has provided PF No. and total amount deposited in my PF account.but when I asked for link with my current UAN on portal. EPFO Office Kandivali west closed my request saying as there is no amount submitted in PF account.what can I do to get it need support from u

I left my previous company( A) in Sep-2007 and joined another company B but I never transferred my PF balance from Company A to present employer EPF account. I want to transfer it now, just want to know if my EPF account from company A is consistenently earning interest from 2007 to till date or it there was a break in between?

Thanks

Hey Krishna, it will be earning interest till the time you are either 58, transferring or withdrawing either of one.

I have 2 questions regarding this –

What happens after age 58? Does this 3 year period reset and continue earning interest if i make a withdrawal within those 3 years indicating activity/operation or is it a complete cessation of accruing interest after 58 and my money stays there without accruing any further interest ?

Also i will retire at 60, so that ~8% contribution of employer that used to go to eps, what will happen to that? Will it go to my epf until i turn 60? Or contributions and interest accrual have completely stopped after me turning 58 and there will be no further additions of any kind neither in form of contributions nor in form of interest? And it is better for me to withdraw and invest somewhere else?

1. If you retire before age 55, EPF interest is payable till you turn 58, even if no contributions are made — this is as per Para 72(6) of the EPF Scheme.

If you retire after age 55, interest is credited for 36 months from the last contribution — irrespective of your age or whether the account is active or not.

So, the concept of “active vs inactive account” is no longer relevant for interest accrual — only the time since last contribution matters.

2. At age 58, your EPS membership ends by default, and the 8.33% EPS contribution is stopped.

However, if you’re still employed and contributing to EPF, you can choose Deferred Pension:

You don’t apply for pension immediately at 58.

Continue working and contributing till age 60 (or later).

You’ll get a higher pension payout when you apply later, as per EPS rules (benefit increases by ~4% per year, up to age 60).

Hi – thanks for the clarification. Just one more clarification is required on taxation aspect. My last contribution before resignation was in nov2022 – Would any interest earned after 3 years of inactivity be taxable? – if yes then any article on how it would be taxed?

Only interest on “contributions made during the year” is exempt.

Once contributions stop, your EPF account is no longer considered “contributory” for tax purposes.

So from the first financial year in which no contribution is made, interest earned becomes taxable under “Income from Other Sources” — even if the account is still earning interest and technically “active” within EPFO’s systems.

Hi,

1. I had EPF contribution over 2.5 lkhs in FY 2023-2024 in Company A. I then contributed 1.5 lkhs in the FY 2024-2025 in Company A’s PF account before changing Job

2. I had changed job and joined Company B in the middle of the financial year 2024-2025. I then contributed 1.6 lkhs in the FY 2024-2025 in Company B’s PF account

3. I had transferred the Company A’s PF account contributions to Company B’s PF account after job change

Question 1: Can you please tell me if my contribution to EPF in FY 2024-2025 is taxable or not as individual PF account contributions are under the limit of 2.5 lkhs but exceed 2.5 lkhs when combined.

Question 2: Do I have to consider Company A’s FY 2023-2024 taxable contribution into account when calculating interest for previous years contribution i.e 10 (12) first proviso?

1. Yes, your EPF contribution for FY 2024-25 will be partially taxable.

Even though individually, both Company A and B contributions are below ₹2.5 lakh,

EPFO treats the PF account at UAN level, and contributions across employers within the same financial year are aggregated.

Since your total employee contribution in FY 2024-25 is ₹3.1 lakh, interest on the excess ₹60,000 (i.e., ₹3.1L – ₹2.5L) will be taxable.

2. Yes, you need to continue tracking the taxable portion from FY 2023-24.

The ₹2.5 lakh cap is applied separately for each financial year.

So, your excess contribution from FY 2023-24 (e.g., if ₹2.5L+ was contributed) will continue to generate taxable interest in FY 2024-25, FY 2025-26, etc., until you withdraw or that corpus exhausts.

So in each future year, two sets of interest may be taxable:

Interest on the carry-forward taxable balance (e.g., excess from FY 2023-24).

Interest on any new excess contribution over ₹2.5L in that year (e.g., FY 2024-25).

Hi , is interest not being given in pf accounts without contributions, from 2025 ?

I have no job and no pf contributions are being done since Sep 2018.

Please help as there is vague info on this on the internet

EPFO Clarification: Interest Continues Even If You Stop Contributing Before Age 55

My last Contribution was April 2024 .How many years Interest will paid by EPF .My Age is 71 Years

If a employee leaves his job after 2011-16,from 2016 to 2025 will he get intrest? Uan was not linked with adhaar,Dob and name was mismatched,and is corrected now by old company Employer,After all correction I will get the access to member portal and then passbook,my question is Is any interest will add on my 82k of amount in the previous 9 years? And If added how much will be added? And if it will not show in my passbook what will I do to have it?

Hey the interest will be credited.

it will be based on every year interest from 2016 -2025 for current year its 8.25%

If it doesn’t reflect you can raise a complain request for the same.

I worked in a company for 4 years i.e from 2020 to 2024 and not worked in any other company befroe or after. I do not have a Job since then. I am 54 now. I have two questions.

1) Will I continue to get interest on EPF till the age of 58?

2) When can I withdraw the full EPF amount so that I should not get any TDS.

1. Interest: Yes, your EPF will continue to earn interest till you turn 58, even though you’re unemployed.

2. Tax-free withdrawal: Your service was 4 years (<5 years), so withdrawing before 58 will attract 10% TDS if balance >₹50,000.

In the above response it is mentioned under point #2, “Your service was 4 years (₹50,000”.

What will happen in the case when service is less than 5 years but EPF is withdrawn after 55 or 58? Will it become tax free then?

No It will still be taxable as the EPF see the service period and not when you are withdrawing to make the EPF fully tax free

My Case Summary

Service period in India: Dec 2005 – Sep 2019 (≈ 14 years)

Shifted abroad: After Sep 2019

PF account: Not withdrawn, not active (no contribution after 2019)

Interest credited: Till 2022, then stopped

Date of birth: 1981 → You’ll turn 58 years in 2039

Question: Will you get interest till 58 years if you withdraw PF at that age? .

As you’re an NRI you won’t get interest after 3 years this benefit of interest till age 58 years is only valid for the Indian resident

Hi – My EPF account has 7+ years of continues service (and transfers from previous jobs dating back to 2010 onwards). If I were to lose job in my mid-40s, will this EPF account continue to earn interest upto the age of 58? Will this interest be taxble during my non-employment years?

Yes you will keep on earning interest but its also true that your interest will be taxable from the period of unemployment

https://www.epfindia.gov.in/site_en/FAQ.php/Disclaimer.php#:~:text=44%20%2D%20How%20long%20an%20employee,from%20the%20stopping%20of%20contribution.

44 – How long an employee can continue his EPF membership?

Ans : There is no restriction of period for membership. Even after leaving the establishment a person can continue his membership. However, if no contribution is received into a PF account for 3 consecutive years the account shall not earn any interest after 3 years from the stopping of contribution.

Read 141 and 142 Q&A for your answer