Don’t Let One Month Decide Your Entire Claim

The excitement of transitioning to a new job often comes with financial considerations—especially when it involves withdrawing your Provident Fund (PF). One such case involved a professional who expected to withdraw ₹4,05,000 but ended up receiving only ₹94,968.

The issue wasn’t eligibility per se—it was how EPFO calculates the advance withdrawal: based on the last month’s contribution, not the total PF balance.

If your last drawn salary was lower than usual—due to an early exit or any other reason—your withdrawal amount can drop drastically. Could this happen to you? Read on to understand how PF advance withdrawals really work and how to avoid such surprises.

Understanding the EPFO Rule for PF Advance

Under Para 68J of the EPF Scheme, members can take an advance from their PF account in specific cases—such as for their own medical treatment or that of a family member.

The maximum amount that can be withdrawn is:

- 6 months’ basic wages and dearness allowance (DA)

OR - Employee’s share of PF with interest

Whichever is less

Then Where Is the Issue?

So why did the individual receive only ₹94,968 despite a PF balance that could support a ₹4,05,000 withdrawal?

A visit to the EPFO office revealed that when officials process a claim, they see only the amount initiated, the reason for withdrawal, and the sanctioned amount as computed by the system—based strictly on EPFO guidelines.

Upon further discussion, it became clear that the system calculates not based on six months’ wages, but instead on the last month’s basic wages and DA. If the last credited salary is unusually low—commonly due to early resignation—the sanctioned amount also drops significantly.

Why Did the Claim Amount Drop So Much?

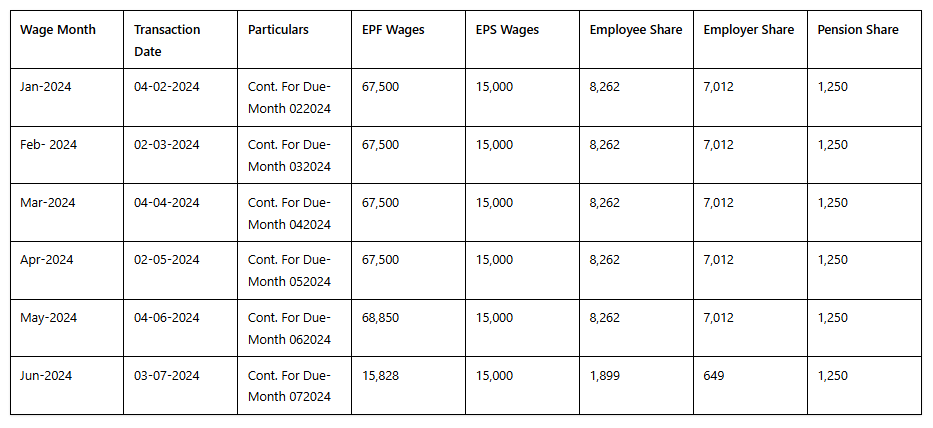

In this case, the individual had a stable salary of ₹67,500 with regular PF contributions. However, after resigning on the 7th of the month, the last month’s PF contribution dropped to just ₹15,828.

Here’s why it mattered:

- EPFO uses the last month’s wage to compute advances.

- For medical claims, the system caps the withdrawal at six times the last month’s contribution.

So, the system calculated:

6 x ₹15,828 = ₹94,968

Instead of being able to access ₹4,05,000, the claim was capped at ₹94,968—leaving him financially stranded despite a sufficient overall balance.

The Multiple Claims & Delays

This lower sanctioned amount often forces members into an extended process:

✔ Multiple claims: Only a portion is approved each time.

✔ Mandatory one-month wait: Between two consecutive claims.

✔ Delays and stress: Especially during urgent times like medical emergencies.

In this case, instead of receiving the full ₹4,05,000 in one go, the individual would have to go through at least four months of claim cycles, each granting only ₹94,968. And even then, the entire amount may still not be accessible without further documentation or delays.

How FinRight Can Help You Get More

This isn’t the end—there’s always a way out. FinRight helps you make the most of your situation.

Most people don’t know this, but EPFO allows for appeals in special cases—especially where the system limitations don’t reflect the member’s intent or financial need.

At FinRight, we help you:

✅ Analyze your employment and PF contribution history

✅ Get real-time insight into your actual withdrawal eligibility

✅ Draft a formal appeal to EPFO for reconsideration

✅ Assist with all necessary paperwork, tracking, and follow-ups

✅ Recommend strategic claim routes to maximize your amount legally

Plan Smart, Withdraw Smart

This situation wasn’t the result of a system error—it was a lack of awareness of how the rules work. With the right information and timing, you can avoid unexpected outcomes.

If you’ve resigned early and noticed a smaller-than-expected PF withdrawal—don’t panic. FinRight is here to guide you every step of the way.

Check your PF withdrawability before applying – Try Fix My PF today!

Take the first step toward financial clarity – Contact FinRight now.

Visit the blog PF withdrawability To understand PF Withdrawals