When it comes to pf balance check, there are several convenient online methods available. Whether you have your UAN (Universal Account Number) handy or not, you can still access your PF balance with ease. Below are the detailed methods:

- PF Balance Check Using UAN Number

The most popular and secure way to check your PF balance is by using your UAN. Here’s how you can do it:

- Activate Your UAN: Make sure your UAN is activated and linked with your Aadhaar, PAN, and bank account.

- Visit the EPFO Portal: Go to the official EPFO website and select the ‘For Employees’ section.

- Access Member Passbook: Click on ‘Member Passbook’ under the ‘Services’ menu.

- Login: Enter your UAN number, password, and captcha code.

- OTP Verification: A one-time password (OTP) will be sent to your registered mobile number.

- View Balance: After entering the OTP, your PF balance details will be displayed.

Note: The passbook will show only the reconciled entries updated by EPFO field offices.

2. PF Balance Check Through UMANG App

The Unified Mobile Application for New-age Governance (UMANG) app simplifies PF balance checks directly from your mobile:

- Download UMANG App: Available on both Google Play Store and Apple App Store.

- Login and Navigate: Use your UAN-registered mobile number to login and navigate to ‘EPFO’ under ‘Social Security Services’.

- View Passbook: Select ‘View Passbook’ under ‘Employee Centric Services’.

- OTP Verification: Enter your UAN, receive an OTP, and submit.

- Download Passbook: Select the employer to view the balance and download your passbook.

3. PF Balance Check via SMS

Even without internet access, you can check your PF balance using SMS if your UAN is KYC-compliant:

- Send SMS: Text ‘EPFOHO UAN ENG’ to 7738299899.

- Language Selection: Replace ‘ENG’ with your preferred language code (e.g., ‘HIN’ for Hindi, ‘MAR’ for Marathi).

- Receive Details: You will get your PF balance details via SMS.

Important: Ensure your UAN is linked with Aadhaar, PAN, and bank details to avail of this facility.

4. PF Balance Check via Missed Call

Another quick option is using the missed call facility:

- Give a missed call to 9966044425 from your UAN-registered mobile number.

- You will receive an SMS with your PF balance details.

Note: This service works only if your UAN is KYC-compliant.

5. For Employees of Exempted Establishments

For companies that manage their own PF trust (exempted establishments), you can’t check your balance on the EPFO portal. Instead, you can:

- Check salary slips for PF contributions.

- Log in to the company’s internal HR portal.

- Contact the HR department directly for updated balance information.

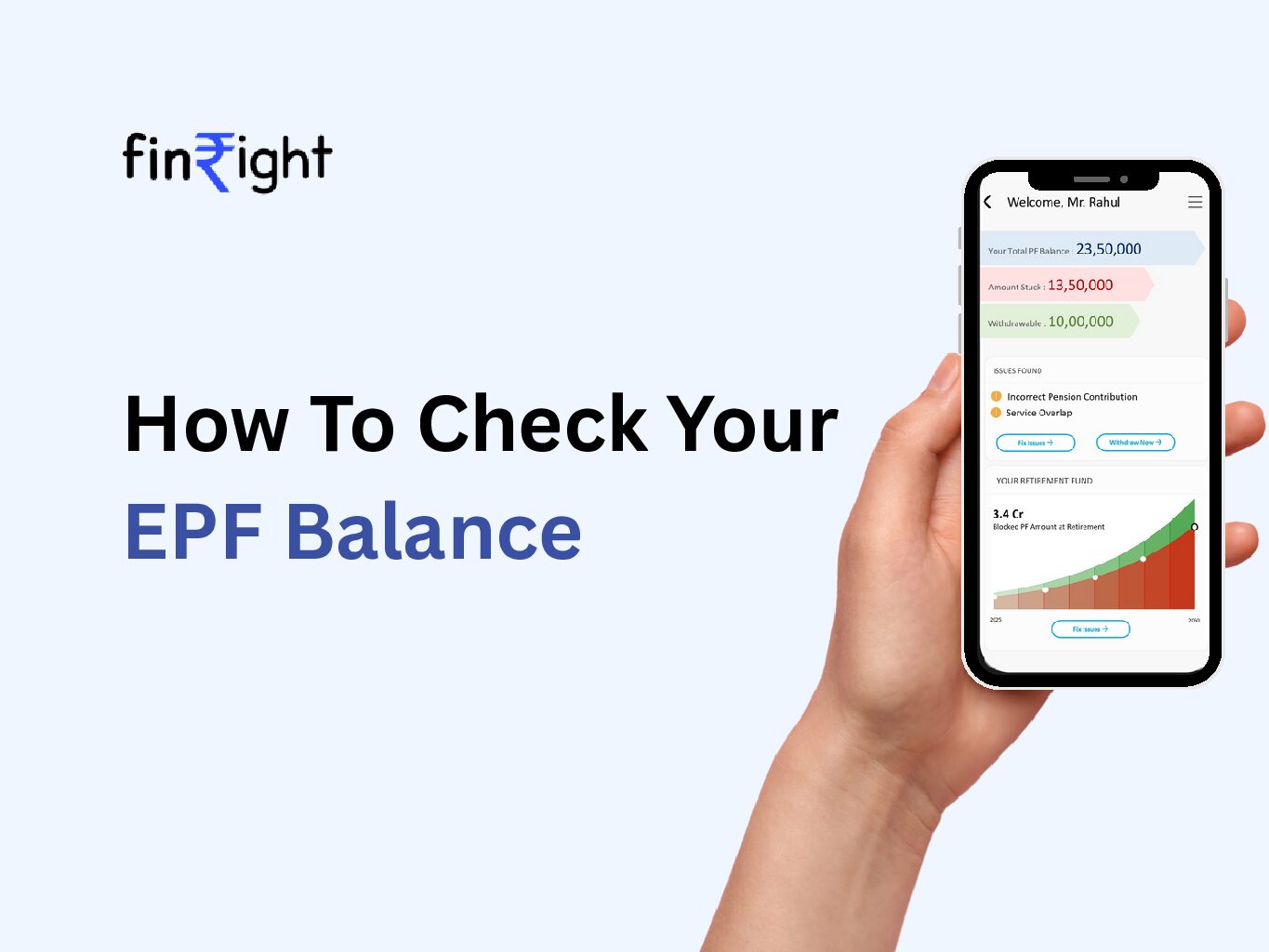

6. FixMyPF: An AI-Powered Solution for Deeper PF Insights

While the above methods help you check your PF balance, they often don’t reveal hidden issues like blocked amounts or pending employer deposits. This is where FixMyPF offers a game-changing solution.

FixMyPF is an AI-powered tool designed to give you:

- Complete PF Balance Check: Get your real-time PF balance data accurately.

- Blocked Amount Detection: Identify any amount that is stuck or delayed due to incomplete documentation or pending verifications.

- Issue Diagnosis: Know exactly what is blocking your funds — whether it’s an employer issue, KYC problem, or EPFO processing delay.

- Actionable Recommendations: Get personalised suggestions on how to resolve issues and expedite fund clearance.

For users who want to go beyond basic PF balance checks, FixMyPF provides transparency, proactive alerts, and peace of mind.

Common Issues While Checking PF Balance

Sometimes you might face challenges while checking your PF balance:

- UAN Activation Issues: Ensure your UAN is fully activated and updated.

- KYC Linking Problems: Verify that Aadhaar, PAN, and bank details are correctly linked.

- EPFO Portal Downtime: Try during off-peak hours if the website is slow or inaccessible.

Why Regular PF Balance Check Is Essential

- Ensures accurate employer contributions.

- Helps in tax planning and financial projections.

- Allows early detection of any discrepancies.

- Keeps you fully prepared for withdrawals or retirement.

Conclusion

Conducting regular pf balance checks is a smart financial habit that keeps your hard-earned money safe, growing, and accessible. While EPFO provides several convenient methods to check your balance, using advanced tools like FixMyPF ensures that you have full visibility into not just your balance, but also any hidden issues that could delay your funds.

Stay proactive, stay informed — and let technology like FixMyPF work for your financial peace of mind.

If you want to withdraw or transfer you can visit us at FinRight

Frequently Asked Questions (FAQs) on PF Balance Check

1. Can I check my PF balance without UAN?

Yes, you can use FixMyPF, an AI-powered tool that helps you check your PF balance even if you don’t have your UAN handy. It primarily sources your UAN based on your Aadhaar-linked and UAN-registered mobile number. You simply need to enter your mobile number, and the tool will fetch your UAN and show you the balance. However, to access the full diagnostic report, including blocked amounts and potential issues, you’ll need to have your UAN and other KYC details ready.

2. Is there any charge to check PF balance online?

No, checking your PF balance through EPFO portal, UMANG app, SMS, or missed call service is completely free.

3. How often should I check my PF balance?

It’s recommended to check your PF balance quarterly or at least twice a year to ensure timely employer contributions and catch any discrepancies early.

4. What is FixMyPF, and how does it help?

FixMyPF is an AI-powered tool that not only allows you to check your PF balance but also detects any blocked amounts, identifies pending issues, and provides actionable solutions to fix them quickly.

5. Why is my PF balance showing less than expected?

Several factors can contribute to this issue, including:

- Recent employer contributions not yet updated

- Delays in EPFO reconciliation

- Blocked amounts due to pending KYC or employer verification (FixMyPF can help identify and resolve these)

- Missing contributions: Contributions may not have been successfully deposited by your employer.

- Unsuccessful transfers: Transfers from previous employers may not have been completed properly.

- Multiple UANs not linked: If you have multiple UANs, your contributions may be fragmented across different accounts.

FixMyPF can help diagnose and resolve these issues.

6. Can I check my PF balance if my mobile number is not registered?

Yes, you can. However, you need to link your new mobile number to your UAN first. Make sure that your mobile number is also linked to your Aadhaar card. Once that’s done, you’ll be able to view your PF balance.

7. What should I do if my PF balance is not updating?

Check if:

- Your employer has submitted the latest contributions.

- Your KYC details are fully updated.

- There are any technical issues on the EPFO portal.

You can also use FixMyPF to diagnose and resolve such issues faster.

8. Can FixMyPF speed up my PF withdrawal process?

While FixMyPF doesn’t directly handle withdrawals, it helps you identify and resolve issues that could delay your withdrawal, allowing for a smoother and faster claim process.